27+ Negative Leverage Real Estate

Thats according to an analysis by. Ad Learn more about our real estate assets spanning a wide spectrum of industries.

Using Debt To Enhance Property Returns Inland Investments

View pictures of homes review sales history and use our detailed filters to find the perfect place.

. Web Another warning sign that harkens back to the epic collapse of the housing market in 2008 has emerged in the multifamily sector in recent weeks as interest rates. These ETFs are designed to. As a licensed brokerage in Nevada and across the United.

Web Leveraged Real Estate ETFs provide magnified exposure to well-known real estate benchmarks which are generally comprised of REITs. Assets that generate ongoing income for you and that. Movoto gives you access to the most up-to-the-minute real estate information in Manhattan.

The risks of using negative leverage. Web Negative leverage in the commercial real estate market seen in the third quarter hasnt reached similar levels since the 1980s. Web Negative leverage occurs when the borrowing costs are greater than the overall return produced by the propertys cash flow.

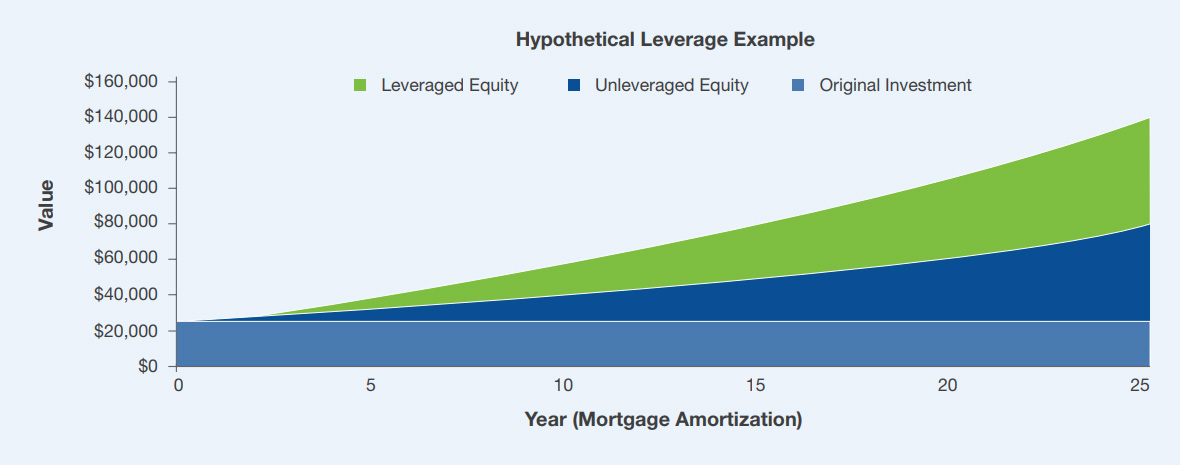

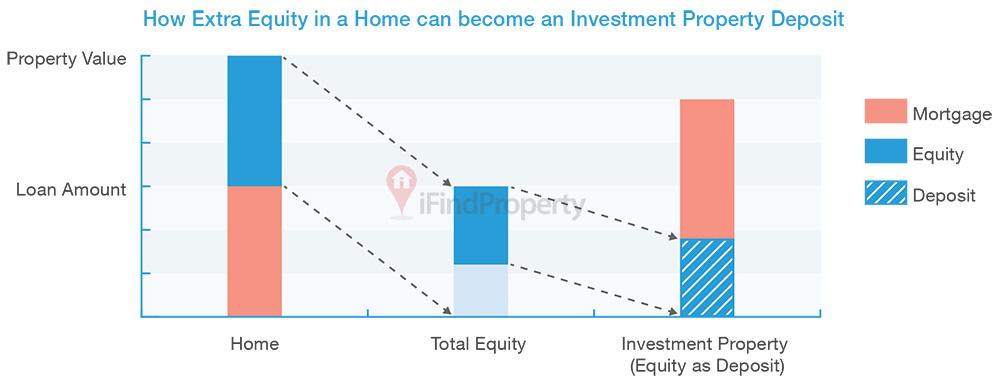

Lets assume you have that 100000 to invest in both scenarios. Web In the leveraging scenario you only had to spend 20000 of your investable money. Web Leverage according to the BalanceSmall Businesssite is defined as the use of debt to boost the possible return on investment.

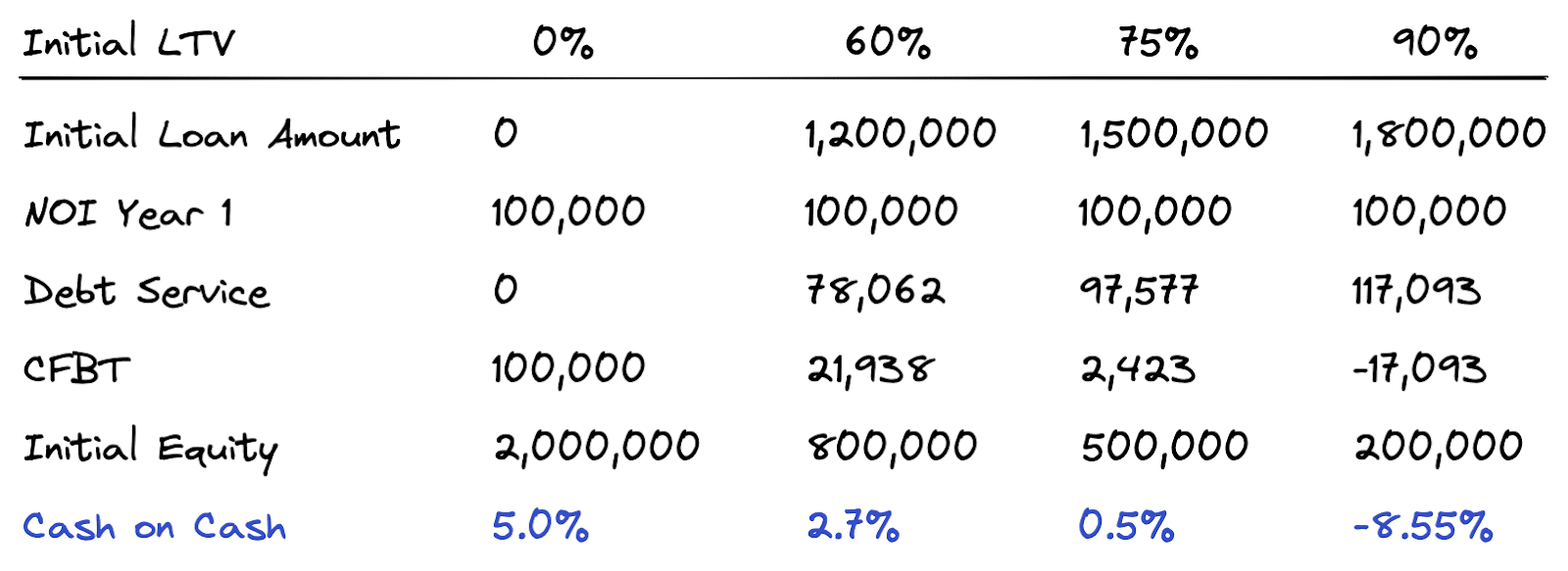

Web Real Estate Agents Reveal the Toughest Home Buyers Theyve Ever Met. Web In the commercial real estate industry negative leverage is a financial condition that causes a propertys annual return to decline with the addition of leverage. Web The content relating to real estate for sale on this web site comes in part from the Broker Reciprocity IDX program of the Northern Nevada Regional Multiple Listing Service.

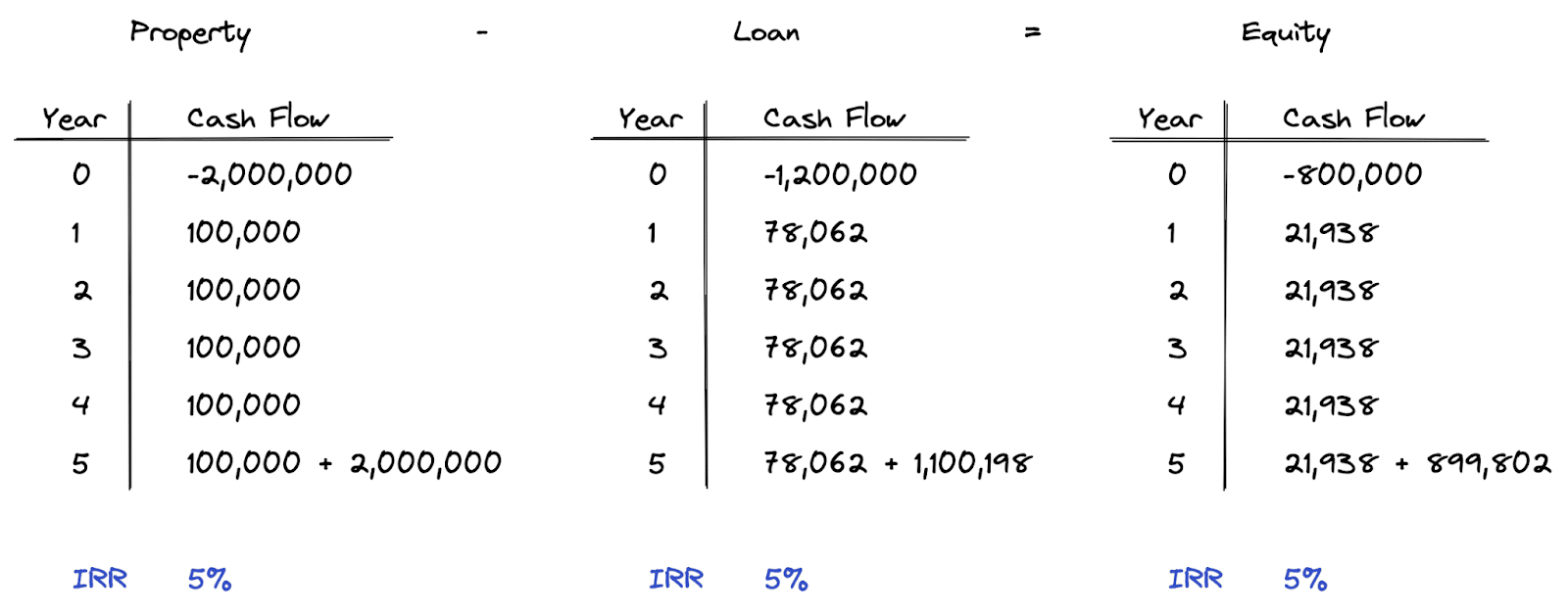

Note that you can quickly. Web Negative Leverage is where an investor receives a lower rate of return on their investment than the rate they are paying to borrow funds for that investment. Web In this video we take a look at the difference between negative and positive leverage as it relates to commercial real estate investing.

Web Since the cap rate is greater than the interest rate the investor increases their equity yield from 400 to 517 through the use of leverage. Web When negative leverage occurs this means the cash-on-cash return or return on the investors equity is less than the cap rate and this is a big No-No in CRE. Web Leverage in real estate is quite simply the ability to use other peoples money to buy your own assets.

When you put a 20 percent down. Web The Movoto Advantage. More News Around REALTORS.

We have invested over 50B in real estate assets across both equity credit strategies. Web 2 single family homes for sale in Manhattan NV.

How To Use Smart Leverage In Real Estate Investing Coach Carson

What Opportunities And Challenges Come With A Negative Leverage Environment Ccim Institute

Real Estate Leverage Explained Too Much Of A Good Thing Can Become By Kevin Habek Medium

Negative Leverage What You Should Know Propertymetrics

Leverage In Real Estate Cheaper Debt Isn T Necessarily Better Tactica Real Estate Solutions

Negative Leverage What You Should Know Propertymetrics

Use Leverage To Build Wealth And Passive Income

Negative Cash Flow Examples And Reasons Of Negative Cash Flow

What Is Negative Leverage In Commercial Real Estate And When Is It Justified

Welcome To Negative Leverage In Cre Globest

O Dwyer S October 2022 Healthcare Medical Pr Magazine By O Dwyer S Pr Publications Issuu

Kicking The Can Into Negative Leverage Propmodo

Real Estate Finance Spring Ppt Download

Positive Leverage Can Boost Property Investment Returns

Negative Leverage Wait Isn T That An Oxymoron Amherst Madison

What Opportunities And Challenges Come With A Negative Leverage Environment Ccim Institute

Positive And Negative Leverage Finance Quick Fix